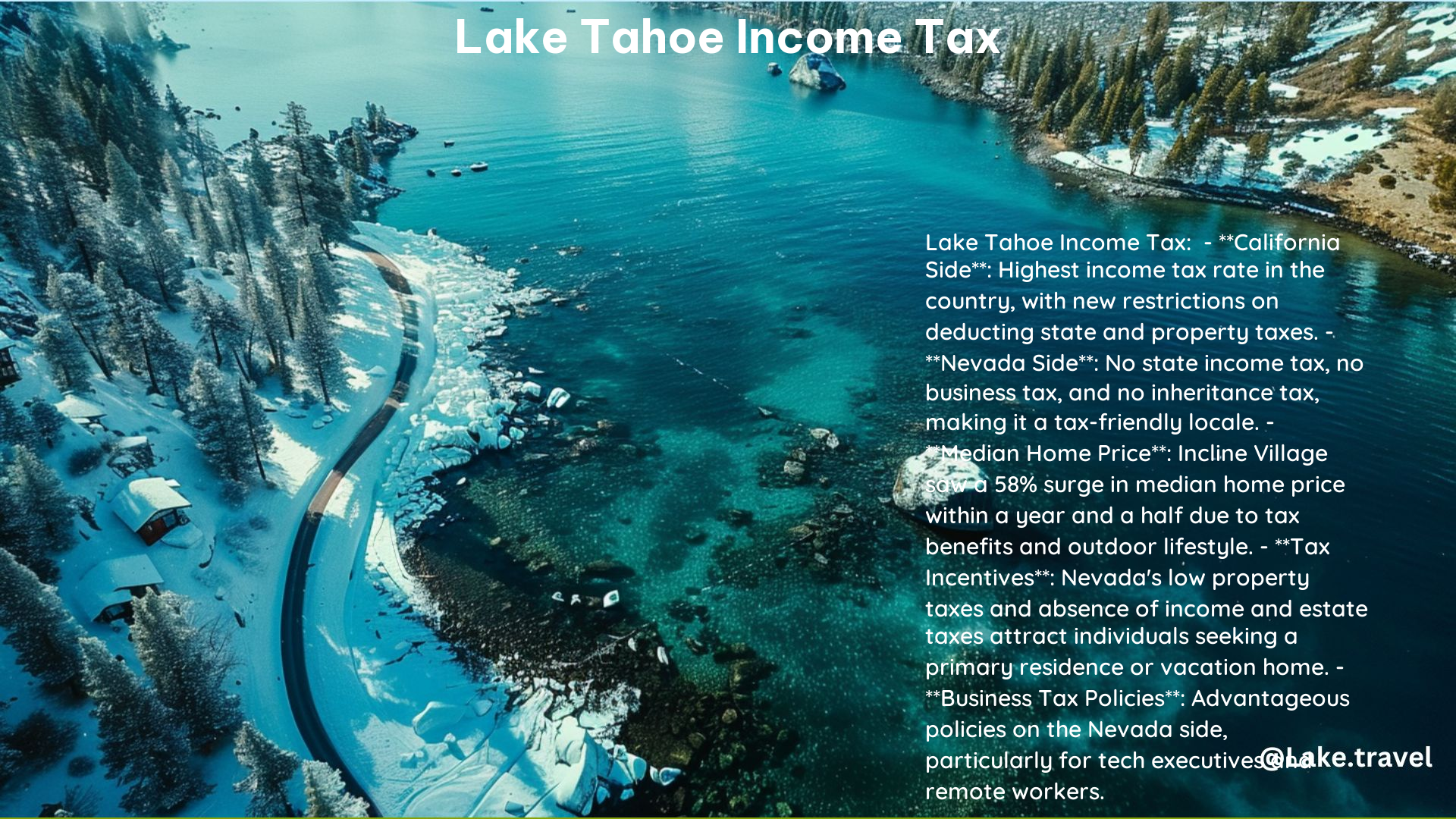

Lake Tahoe, situated on the California-Nevada border, offers unique tax advantages depending on the state of residence. This comprehensive guide delves into the key details and services for taxpayers in the Lake Tahoe area, covering tax services, Nevada’s tax advantages, California’s tax rates, and free income tax preparation options.

Tax Services in South Lake Tahoe, CA

Taxpayers in the South Lake Tahoe area can find professional assistance from the following accounting firm:

- Bruce L. Cable, CPA: Located at 298 Kingsbury Grade, Stateline, NV 89449, this accounting firm provides tax services within a 4.0-mile radius from South Lake Tahoe.

Nevada Tax Advantages

Residing in the Nevada side of Lake Tahoe can provide significant tax benefits:

- No State Income Tax: Nevada does not have a state income tax, which can be advantageous for those who work from home or travel extensively.

- No Business Tax: Nevada does not impose a business tax, making it an attractive location for entrepreneurs and businesses.

- No Inheritance Tax: Nevada also does not have an inheritance tax, which can be beneficial for estate planning.

California Tax Rates

For those living on the California side of Lake Tahoe, the following tax rates apply:

- Sales Tax Rate: The minimum combined 2024 sales tax rate for South Lake Tahoe, California is 8.75%, comprising state, county, and city sales tax rates.

Free Income Tax Preparation for Low-Income Households

Residents of the Lake Tahoe area can take advantage of free income tax preparation services if they meet certain income requirements:

- Free Tax Preparation Programs: There are free income tax preparation programs available for low-income households in Lake Tahoe. These programs are typically offered through local non-profit organizations or community centers.

Additional Resources

Taxpayers in the Lake Tahoe region can also utilize the following resources:

- Revenue Services Division: The City of South Lake Tahoe’s Revenue Services Division handles the collection of major city revenues, including Transient Occupancy Tax and Business and Professions Tax.

- Tax Compliance Resources: For businesses, automating sales tax compliance can help keep up with changing sales tax laws in California and beyond.

By understanding the unique tax landscape of Lake Tahoe, residents and businesses can make informed decisions and take advantage of the available tax services and resources.

References

- https://www.yelp.com/search?cflt=taxservices&find_loc=South+Lake+Tahoe%2C+CA

- https://clearcreektahoe.com/tax-advantage/

- https://www.cityofslt.us/168/Revenue-Services-Division

- https://www.avalara.com/taxrates/en/state-rates/california/cities/south-lake-tahoe.html