The South Lake Tahoe Vacancy Tax is a proposed tax on residential properties that sit empty for more than 182 days in a calendar year. This tax aims to address the issue of vacant properties in the area and increase the availability of housing units for locals. However, the tax comes with several exemptions that Lakes Touring Enthusiasts should be aware of.

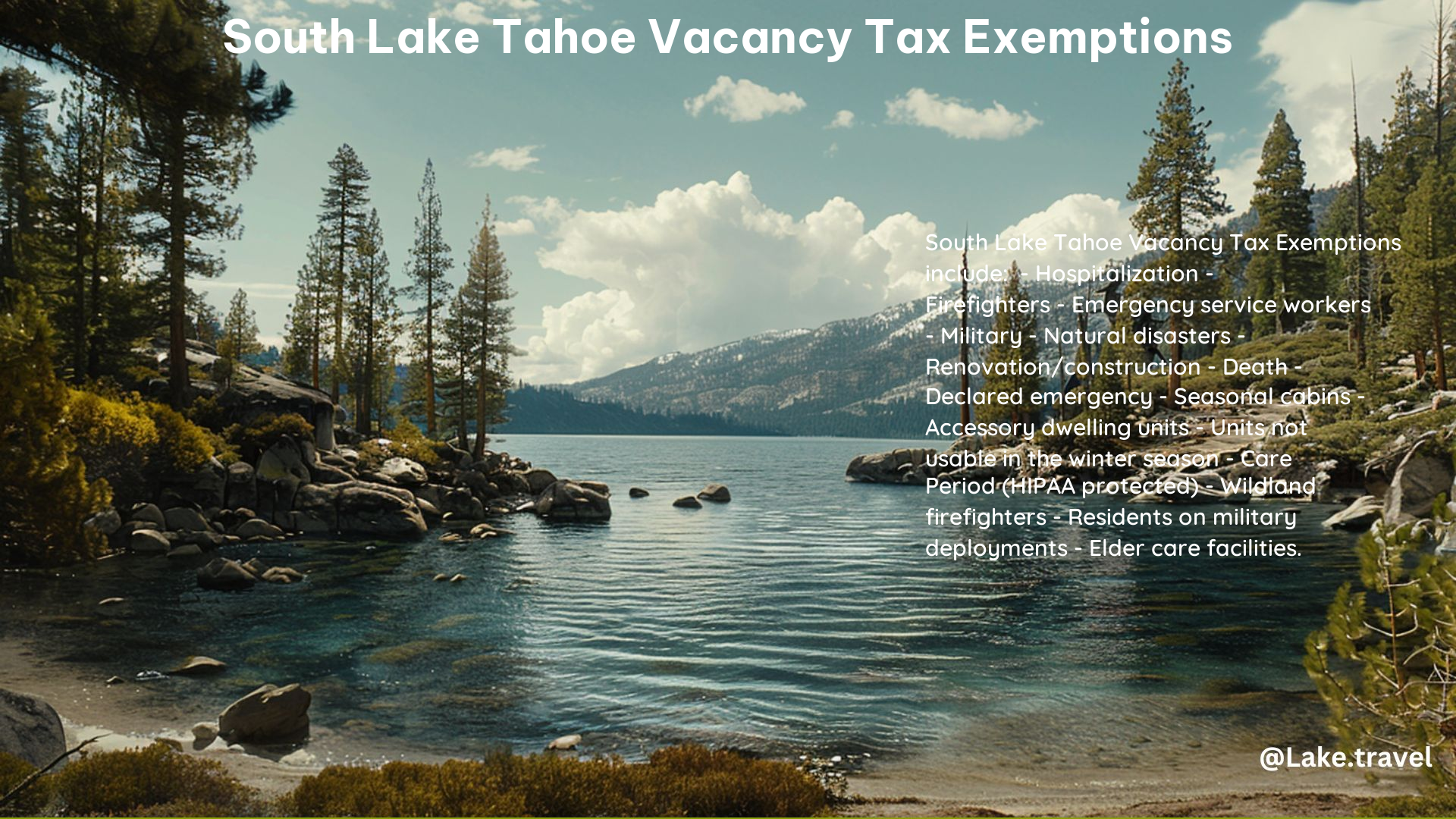

South Lake Tahoe Vacancy Tax Exemptions

The South Lake Tahoe Vacancy Tax has several exemptions that property owners can take advantage of. These exemptions are designed to ensure that the tax does not unfairly burden certain property owners or situations. Here are the key exemptions:

Rental Properties

Properties that are rented to tenants for more than six months in a year are exempt from the vacancy tax. This exemption is intended to encourage property owners to make their properties available for long-term rentals, which can help increase the supply of housing for local residents.

Construction Projects

Properties that are undergoing renovation or construction are exempt from the vacancy tax. This exemption recognizes that these properties are not truly vacant, as they are being actively worked on to improve or prepare them for occupancy.

Seasonal Cabins

Seasonal cabins that are only usable for part of the year are exempt from the vacancy tax. This exemption acknowledges the unique nature of these properties, which are often used for recreational purposes rather than as primary residences.

Hospitalization and Long-Term Care

Properties where the occupant is hospitalized or in long-term care are exempt from the vacancy tax. This exemption ensures that the tax does not unfairly burden those who are unable to occupy their homes due to medical reasons.

Firefighters, Emergency Service Workers, and Military Personnel

Properties owned by firefighters, emergency service workers, and military personnel are exempt from the vacancy tax. This exemption recognizes the important roles these individuals play in the community and the unique circumstances they may face.

Natural Disasters and Declared Emergencies

Properties affected by natural disasters or declared emergencies are exempt from the vacancy tax. This exemption provides relief to property owners who are unable to occupy their homes due to these extraordinary circumstances.

Death of Occupant

Properties where the occupant has passed away are exempt from the vacancy tax. This exemption acknowledges the challenges and complexities that can arise in the aftermath of a death.

Implementation and Enforcement

The South Lake Tahoe Vacancy Tax is set to be implemented starting in 2026. The tax will be $3,000 for the first year and $6,000 for consecutive years. The City Council will have the authority to amend the exemptions and penalties by a majority vote.

Revenue Allocation

The revenue generated from the South Lake Tahoe Vacancy Tax will be dedicated to affordable housing, road repairs, and public transportation. This allocation of funds is intended to address some of the key challenges facing the local community.

Controversy and Opposition

The proposed South Lake Tahoe Vacancy Tax has sparked controversy among residents, with some arguing that it is unfair to second-home owners and may not effectively address the housing crisis. A coalition called “Stop the South Tahoe Vacancy Tax” has formed to oppose the measure, citing concerns about the city’s ability to enforce the tax and the lack of guarantees that the revenue will be used for affordable housing.

As a Lakes Touring Enthusiast, it’s important to stay informed about the South Lake Tahoe Vacancy Tax and its exemptions. By understanding the details of the tax and the available exemptions, you can ensure that your property ownership and usage aligns with the city’s goals and regulations.